| |

Fine Art as an Investment

There is more money in the world than great paintings by John Jan Popovic

Fine Art as an Investment

WHY IS ART VALUABLE?

There is more money in the world than great paintings, so a competition among buyers will always exist for superior artworks.

Merril Stevenson wrote in the Economist, more than 20 years ago: "The art market is less perfect than most financial markets. Products are one-offs and less fungible than bonds, for instance. That should give the seller more control over prices. But art is also less liquid: the seller cannot simply unload his asset whenever he wants to, or the buyer buys it, is if it is an IBM share. Dealing costs in art can be high. And less information is available in the art world.."

Famous English aristocrat, Lord Duveen, the legendary London art dealer of 1920s and 30s, convinced the nouveux riches of his day that art was more important than a money. Before late 1970s' fine art was generally perceived as a luxury," says Mr Richard Feigen, an American dealer, "No matter what your financial capacity, there is a limit how much you will spend on luxury. When art was perceived as a financial instrument, there was no limit on how much to spend." It was a magical moment of 1980s' uniting of two obsessions, collecting and speculating, that put an even heavier upward spin on art than on most other asset prices.

Quality in art has absolute standards. Exceptional art has a master's touch. It's a gift. Few artists possess or develop such extraordinary skill and talent. Hence, the expression, "a stroke of genius," could well refer to the brushwork and technique of a great artist.

Recognizing quality in art takes time. It's best learned with the help of an expert or mentor. Unless you understand "value" in art (or anything else), it's impossible to understand opportunity. And to understand value, you have looked at hundreds, even thousands of paintings. Learning about art is lifelong. When you arrive at the threshold of connoisseurship, and can see art at a gut-level, you're ready to begin buying and selling art for a profit.

Fine art investment is valuable for three reasons:

(1) superior quality artifacta ensures prestige, status and respectability to the owner

(2) unique aesthetic value

(3) market scarcity

Some people who deem scarcity as prize-worthy, are willing to pay an exorbitant price for the last anything on earth that someone else wants, needs, or admires. You might have heard, they stopped making 19th century art more than one hundred years ago.

The value of a painting is based on supply and demand and establishing such supply and demand takes knowledge and experience. Dealers and employees of the auction houses have a good idea of a painting�s value and despite the fact that paintings which sell considerably over the estimate receive good press coverage, most paintings sold at auction do actually sell within their estimate.

When assessing this supply and demand, among the factors to be taken into consideration are:

* How common are works by this artist?

* How many works of this type by the artist remain in private hands and are likely to come on to the market?

* Is this a good example of the artist�s work from a good period of his artwork?

* How many different purchasers are interested in this type of painting?

* What sort of purchasers are interested in this type of painting, for example museum, private, corporate?

It takes many years of experience to be able accurately to apply this exercise to a painting. Both auction rooms and dealers are normally happy to give collectors the benefit of their experience. Although the auction rooms currently take a commission from both buyer and seller, their primary responsibility is to the seller.

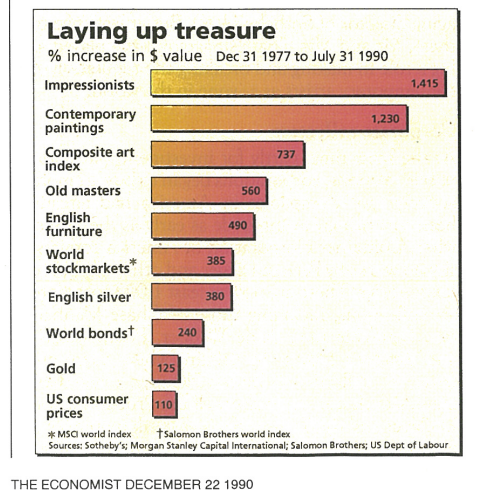

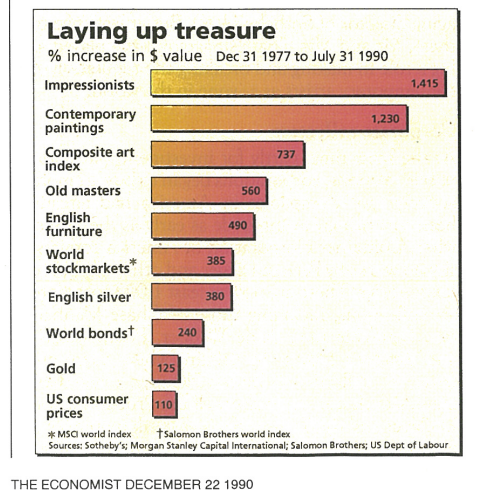

A piece by Andy Warhol worth $1,000 in 2005 is worth about $3,250 today. Simply put, the art market is consistently showing impressive returns, often beating out traditional investments. Two business professors from New York University agree. Michael Moses and Jiangping Mei have complied and tracked the performance of fine art. The Mei Moses Index covers Impressionist, Modern, American (before 1950), and Old Master artists. "From last year, through the end of 2007, all our index was up 20% while the S&P total return was up 5%," says Michael Moses (co-founder, Beautiful Asset Advisors). The art index has underperformed the equity index for the last 25 years. Over the last five and ten year periods art has significantly outperformed equities.

Hilton Kramer, former art critic of the New York Times and editor of the publication

New Criterion, states "there is a whole class of buyers primary interested in buying works of art that others are seen publicly to want".

------------------------------

Fine Art as an Investment

------------------------------

The attraction of art as an investment is that fine art provides an opportunity for portfolio diversification into an area that has historically provided high returns and shown a low correlation to other asset classes.

When art prices fell during the Depression in the 1930s, they did not regain their real level of 1913 until 1945. Since the end of World War II the value of art works has appreciated enormously. Quality works of art have proved to be a remarkable store of value. This is predominantly due to increasing rarity caused by an expanding demand from museums and collectors, and dwindling supplies.

The very rapid price rises that characterised the market at the end of the 1980s and the early 21st century were the result of speculation. The market has become much more selective, with an emphasis on quality.

Price trends

Around 15,000 Old Master lots are currently coming up for auction annually. This equals the 1989 level which then dropped off to about 12,000 at the depth of the recession in 1993. Turnover peaked in 1989 at £(pounds) 280,000,000 and has since levelled off at £200,000,000 having bottomed in 1993 at £140,000,000. So, it can be seen that the market has recovered the amount of lots being sold but has only recovered two thirds of its turnover. This only really affects the buyer of middle ranged goods which have not yet recovered the euphoric heights of the late 1980s. The market is currently selective and for excellent paintings is even stronger than it was in 1989.

The strongest areas today are the Eighteenth century Venetian vedute or view painters such as Canaletto, Guardi, Marieschi, Carlevarijs and Bellotto, and the Dutch and Flemish painters of the Seventeenth century such as Rembrandt, De Hooch, Hobbema, Salomon van Ruisdael, Jan Steen, Adrian van Ostade, Pieter Breughel the Younger and Jan van Huysum.

The experience and knowledge of The Fine Art Fund Group�s experts enables The Funds to identify fine art for investment often before it becomes publicly available.

Historically, art has provided significant financial returns. Given market trends and opportunities the Manager expects it to continue to do so. A highly professional management team allows The Funds to build a portfolio of works of art that outperforms the general art market.

---------------------------------------------------------------------------------------

CASE STUDY: Vincent Van Gogh�s "Irises"

What makes a painting worth so much money?

--------------------------------------------------------------------------------------

by Mary Dymon

An upsurge of excitement rippled through the art market when Vincent Van Gogh�s masterpiece, "Irises", sold for a record price of $53.9 million at the New York Galleries of Southeby Park Bernet a few years back. The staggering sum for the Van Gogh remains the highest price paid for a painting at public auction to date.

"Irises" came from the collection of John and Joanne Payson, avid art collectors and owners of Hobe Sound Galleries, Florida and Maine, and The Midtown Galleries, New York. Prior to the sale, the Van Gogh had been exhibited (courtesy of the Paysons) at the Westbrook College Museum in Maine.

"The buyer is unknown. He was represented by an agent at the auction and only three or four individuals at Southeby�s were aware of his identity," Payson explains. "Even though the event received worldwide attention and careful scrutiny by the media, he has been able to preserve his anonymity."

What determines the price of a painting? Payson says the artist is the most significant factor, but only a starting point. To bring a top price, a painting must also be thoroughly typical of the artist. In other words, for a painting to bring a high price, even when the artist is considered to be a master, the painting must also have been painted in the style which people have come to think of as characteristic of the artist. Van Gogh�s "Irises" exemplifies this point.

Prices have been rising at a phenomenal rate at every major art auction since the 1950s. In the span of a single week this past November, Sotheby�s and Christie�s sold an unprecedented $430 million of artwork between them. Works from three single-owner collections accounted for nearly 40 percent of the total. Also, in 1988, the sale of Jasper John�s "False Start" at $17.05 million established a record for a painting by a living artist.

Payson predicts the next individual sale to shake up the art world will occur next fall when a Picasso will probably appear in the market. "That sale should be in excess of $60 million," he says. A work by Picasso, "Acrobate et Jiune Arlsquim", was sold for $38 million late in 1988 in London.

Such tremendous growth in the participation of art collecting and dealing today has brought an increasing fascination with the art market and the way it works. Collectors vary from the young enthusiast who ventures $100 for a painting by an unknown artist, to the deep pocket connoisseur who pays millions for a work by a great master like Van Gogh. There are more people collecting art now than at any other period in history, and they are collecting from a wider spectrum of artists and mediums.

For the first time ever, a living artist like Jasper Johns can make a good living. Yet relatively few people, even among collectors, know why art has become such big business. Both buyers and sellers continue to ask themselves: "what is this work of art worth?"

Values in the art market have never been clearly defined, but valuations are continually being demanded for tax and other purposes. Accepted price levels for works of art are established by the interplay between auctioneers and dealers. (Public auctions are generally attended by large groups of interested dealers.) A market for art exists simply because most people take natural pleasure in possessing beautiful things. In fact, Payson advises beginners to concentrate on their own likes and dislikes as opposed to value potential.

"When you start collecting art, you shouldn�t think about the investment potential in it. Buy it because you like it," Payson says.

A market for art is created the moment two people wants to possess the same work of art. A middleman, usually an auctioneer or dealer, then comes on the scene to determine which of the two parties is prepared to pay the higher price.

Fine art is becoming more and more a part of the public psyche. There are art galleries and art stores, books on art, magazine devoted to every facet of the subject, newspapers with art sections and now, even a cable TV station. The overall demand for artwork is booming.

Another factor on the demand side of the art market is the influence of the schools of investment in vogue at a given time. Those watching the financial transactions of the wealthy follow art investment trends, adding to the demand for works by particular artists.

On the supply side, the supply of fine artwork is absolutely limited. With notable exceptions like Jasper Johns, investment-quality artwork generally implies a dead artist. As more of this limited supply is purchased, there is progressively less available for sale. So, the remaining demand must be satisfied out of this limited and now-decreased supply.

It looks like the perfect investment: An increasing demand coupled with an absolutely limited supply. Now, add to that the prosperity of the 1980�s and you will begin to understand the attraction of the art market.

This period of plenty has created surplus funds for an increasing segment of the population. Stock market yields have been low overall, making this market progressively less attractive to the individual investor. Art, as an alternative investment, is not being overlooked.

"Collecting art for the purpose of investment must be carefully considered. We�re talking about a long-term investment," Payson explains. "Art buys can be a hedge against inflation, but you must understand that most appreciation occurs over time."

Payson began his collection at 21 years of age when he fell in love with a painting and bought it. His mother, Joan Whitney Payson, was even younger when she started collecting at age 19. It was Mrs. Payson who acquired "Irises" at an auction in 1947 through the guidance of a private dealer, Carman Messmore-Knoedler. She paid $80,000. Legend has it that Mrs. Payson thought the price tag was too high. It was Messmore who encouraged her to make the purchase by teasing, "Now Joan, don�t be so stingy!" (By the way, "Irises" first sold for 250 francs in 1891.)

"You can see why it is very important to like the art you buy since you will probably have it for a significant period of time," Payson says. "Surprisingly, it doesn�t require a large investment to start. It does require study and knowledge, however,

"Let�s say, for example, you like American realists from the 1930s and 40s. Find the galleries that sell that kind of work. Ask the dealers about the arrangements, terms and details concerning tradebacks. Will they stand behind the painting? When considering the price of a work, there are certain guidelines, points where you should take a closer look. If a watercolor is priced over $1,200 or an oil over $5,000, start asking some questions: Is the artist included in a museum or corporate collection? Is the artist alive? Has he or she participated in any major shows? Get as much information as possible. Also, check the auction records.

"You will probably acquire from only a handful of galleries. My mother acquired from three galleries, two in New York and one in London.

"Interaction at the top level, the auction market, should be approached very cautiously. Works more than 100 years old are not guaranteed by large auction houses. You should work with a dealer you trust implicitly. A good dealer will study the provenance of a painting, tracing its history to its origin. Your dealer may also work with an art expert in determining provenance. Also, it it�s the dealer who should advise you on how high to bid, or you may want to ask him to bid for you."

With his subtle grin and gentle personality, Payson possesses the soul of an artist himself. His is sensitive, perceptive and has acquired the ability to recognize great art. Payson brings to his Hobe Sound Galleries an impressive array of outstanding new artist. Many of these new artists he helped develop himself either through his school in Maine or by offering the artist the opportunity to show. In sum, the art in his gallery in Hobe Sound is a reflection of the man himself: Colorful, yet subtle, thought provoking, intelligent and financially sound.

Payson, like many important collectors of paintings, does not buy art just to sell it. His paintings are his treasures and a major love of his life. Of course, a price tag can be attached, as with the Van Gogh, but more often it is enough for Payson to know that the value is there and that it can be passed on to museums or public institutions as his contribution to the cultural aspect of society.

Art investment is often cloaked by a veil of secrecy. It is a very personal marketing process based more on human emotion than on any predictable market formula.

In the end, the investor-collector comes back to a subjective assessment of quality. As beauty lies in the eye of the beholder, so lies value in the mind of the buyer.

---------------------------------------------------------------------------------------------

Bibliography & links

The Economist, A Survey of the World Art Market, by Merril Stevenson, December 22, 1990

http://www.oldmasters.net/essay-5.html

http://www.slate.com/id/2144185/

|

|